Top Telco for 2024 based on Kpilog analysis

Results of our analysis to identify the highest ranking Telco in 2023.

The results are in and we have a new winner of our annual award for the Top performing Telco across the world.

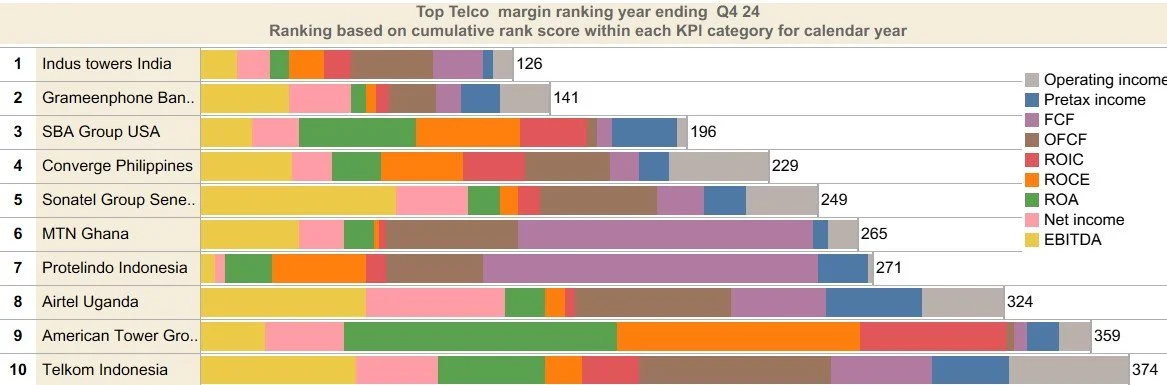

2024 Kpilog.com Top Telco Global ranking

The Global top 3 come from our AAPAC and Americas regions.

1. Indus Towers is a the 3rd largest Towerco in the world and continues to deliver strong performance with Tenancy ratios of 1.65 at EOY 2023 driving strong cash flow and margins.

2. Grameenphone has long been an established leader in the Bangladeshi market and benefits from market leading position in a densely populated country of 173m

3, SBA is the number 9 in terms of number of Tower sites across the world but has a high tenancy ratio of 2.10 in the lucrative American market. Long term relationships with the major American MNOs underpins its performance ensuring ongoing returns for its investors.

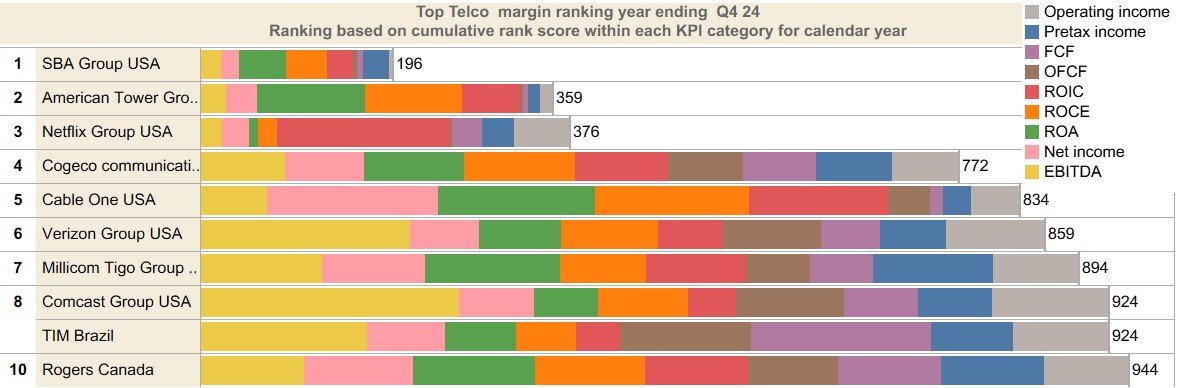

2024 Kpilog.com Top Telco Americas ranking

1. SBA Group is the 2nd largest Towerco operating in the American market and is consistently a top performer in our analysis and has a long track record of delivering profits.

2. American Tower Group is the 4th largest Towerco with 148k towers at EOY 2024 with operations in USA, South America and Europe. Long time favourite of the investor community and has delivered a reliable return for many years.

3. Netflix Group is currently winning the streaming wars with a 9% growth in paid subscriptions in 2024 ending with 301m paying subscribers. Ability to increase subscription fees and improved restrictions on sharing have been key features of its progress in 2024.

2024 Kpilog.com Top Telco Europe ranking

1. PPF Telecoms group is an investment group focussed on Mobile and fixed assets in central and eastern European markets - notably Czech, Hungary and Serbia and continues to drive growth and efficiencies across its operations in the CEE.

2. Telenor group had a successful 2024 driven by growth in its key Nordic operations. Service revenues were up 3.3% with growth in FCF and EBITDA also apparent.

3. Megafon Russia has managed to stabilise its domestic operations in the face of international sanctions and a 13% growth in revenues in 2024 has contributed to a successful 2024

Top Telco for 2023 based on Kpilog analysis

Results of our analysis to identify the highest ranking Telco in 2023.

One of our primary goals in establishing this service was to identify and rank telecommunications companies based on their performance—a challenging but worthwhile endeavour, we believe. Telco operators reporting often highlights the positives while minimizing the underlying performance challenges and our goal is to enable industry wide benchmarking and peer comparisons for our customers.

Now how to do this?

Ultimately, it was determined that no single metric could capture the comparative performance of global Telcos. Therefore, we decided to rank each Telco we monitor across seven different metrics and then sum these rankings to obtain a cumulative performance ranking.

We understand you may not agree with our metrics, but we believe it's a reasonable broad-brush approach and serves to prompt a conversation for those who wish to engage. Additionally, we allow our customers to customize which metrics are included based on their personal preferences and based on feedback we will evolve the analysis to include additional metrics over time.

So to cut to the chase the 9 metrics we chose are as follows;

Operating income margin - a universal metric which is reasonably standard across different accounting standards - we exclude any once-off profits related to sale of assets.

Pretax profit margin - again excluding once-off gains

Free Cash Flow margin - includes Capex and Lease/ROU as well as any spectrum purchases - usually CFFO-Capex-Lease or ROU- Spectrum

Operating free cash flow margin - usually EBITDA-Capex - ROU/Lease costs, this is not a very comparable metric due to the differing EBITDA calculations that abound but fit for purpose we believe.

ROIC = 12 month NOPAT(Net operating income after tax)/Invested capital(Total debt + Shareholder equity)

ROCE = 12 months EBIT/(Total assets-Current liabilities)

ROA - Return on assets = Total assets/12 months Net income

Net income margin = Net result for last year

EBITDA margin - beloved by many but hated by as many!. We had to include this but comparability is difficult from a Global perspective and arbitrary reporting by Telcos for a KPI which has no standard IFRS or GAAP definition.

The analysis is done based on a calendar year and it requires that we wait until mid-year to get some full year reports from Telcos whose financial year end in March or June

We track revenue and operational metrics like subscriber numbers, but ultimately, we believe these elements should not be included. As is commonly understood, growth in subscribers or revenue does not necessarily equate to profit growth.

2023 Kpilog.com Top Telco Global ranking

The Global top 3 all come from our AAPAC region.

1. Grameenphone has long been an established leader in the Bangladeshi market and benefits from market leading position in a densely populated country of 173m

2. MTN Ghana is an effective monopoly in the 3 operator Ghanaian market accounting for over 75% of revenues and subscribers within the market.

3.Converge is a relative newcomer in the Filipino broadband market and a rapid FTTH rollout in recent years has contributed to significant revenue and subscriber growth while profit margins have been maintained.

2023 Kpilog.com Top Telco Americas ranking

1. DTH operators are usually high margin with strong cash flows and Telesat is a leader in this regard who has managed to maintain its revenues across North and South America as well as in Europe in the face of an increasingly competitive market. Once off gains from spectrum consolidation and FX contributed to a stellar 2023.

2. SBA Group is the 2nd largest Towerco operating in the American market and has a long track record of delivering profits.

3. Crown Castle is a long established Towerco with a low cost base and high quality tenants in the North American market with a market leading tenancy ratio of 2.5 at EOY 2023 - no major international expansion in recent years which has helped to maintain the healthy profit margins.

2023 Kpilog.com Top Telco Europe ranking

1. Inwit Italy is a leading Towerco in Italy, having been established through the merger of Telecom Italia and Vodafone's towers. With an improving tenancy ratio of 2.23 at the end of 2023, it stands as a highly profitable entity.

2. PPF Telecoms group is an investment group focussed on Mobile and fixed assets in central and eastern European markets - notably Czech, Hungary and Serbia.

3. The Cetin Group is a subsidiary of the PPF group represents another significant infrastructure presence across Central European nations such as the Czech Republic, Bulgaria, Hungary, and Serbia. It boasts a varied range of both active and passive services catering to fixed broadband and mobile operators within these regions.